The Sahm Rule was created around 2019 as a lagging indicator for recessions, designed to signal when the economy is already in recession (without false positives) but still in its early stages. The goal is to enable fiscal policies that can mitigate the recession's effects as much as possible.

Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months.

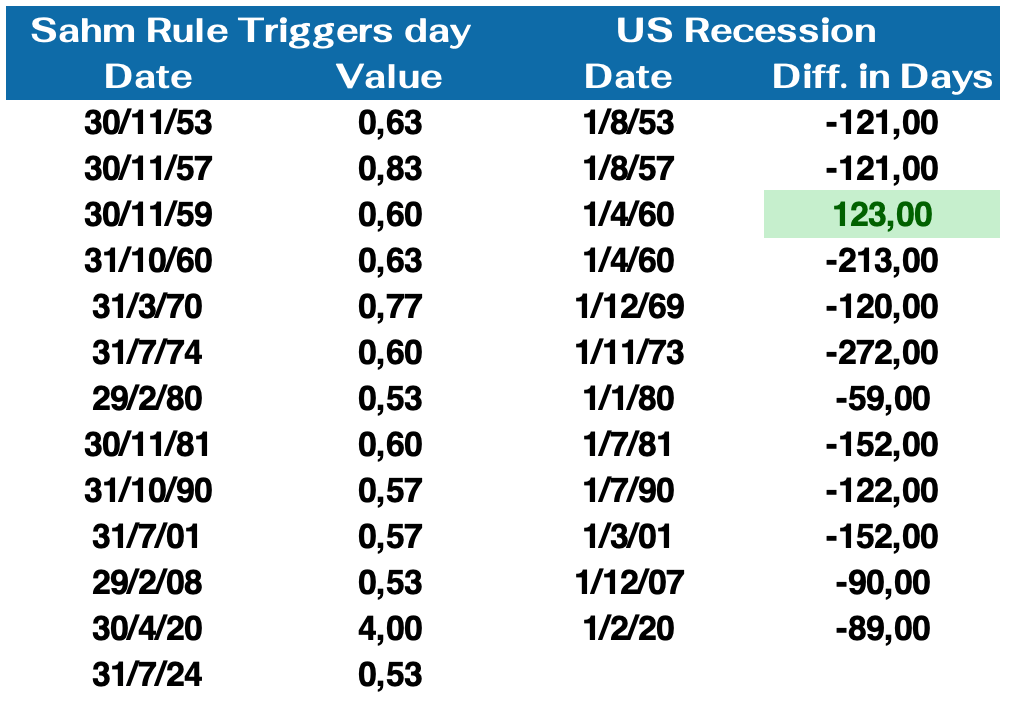

Since 1953, the signal has been triggered 13 times, with the economy not in recession on only two occasions (1959 and 2024). However, in 1959, a recession occurred roughly four months later.

The 0.5 threshold in the Sahm Rule represents a point of "no return." When the indicator reaches this limit, the trend typically continues upward, signaling labor market issues and rising unemployment (with 1959 being the only exception so far).

In this instance, the economy is not in a recession, and the signal may have been triggered due to various shocks in recent years affecting labor market dynamics. First, there was COVID-19, followed by a significant increase in the U.S. labor supply due to immigration.

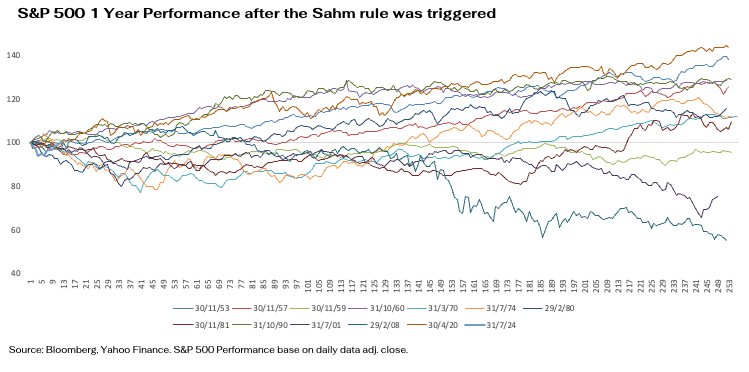

Now, let’s examine how the market has performed one year before and after the Sahm Rule has been triggered, using the adjusted daily closing prices of the S&P 500 as the benchmark.

Given that the Sahm Rule is activated when the economy is already in recession, we can observe that returns one year prior are generally poor, with most cases showing negative performance. As for performance one year after the signal, the results are highly variable. However, it is noteworthy that negative performance only occurred in three instances: 1959 (the false positive), 2001, and 2008.

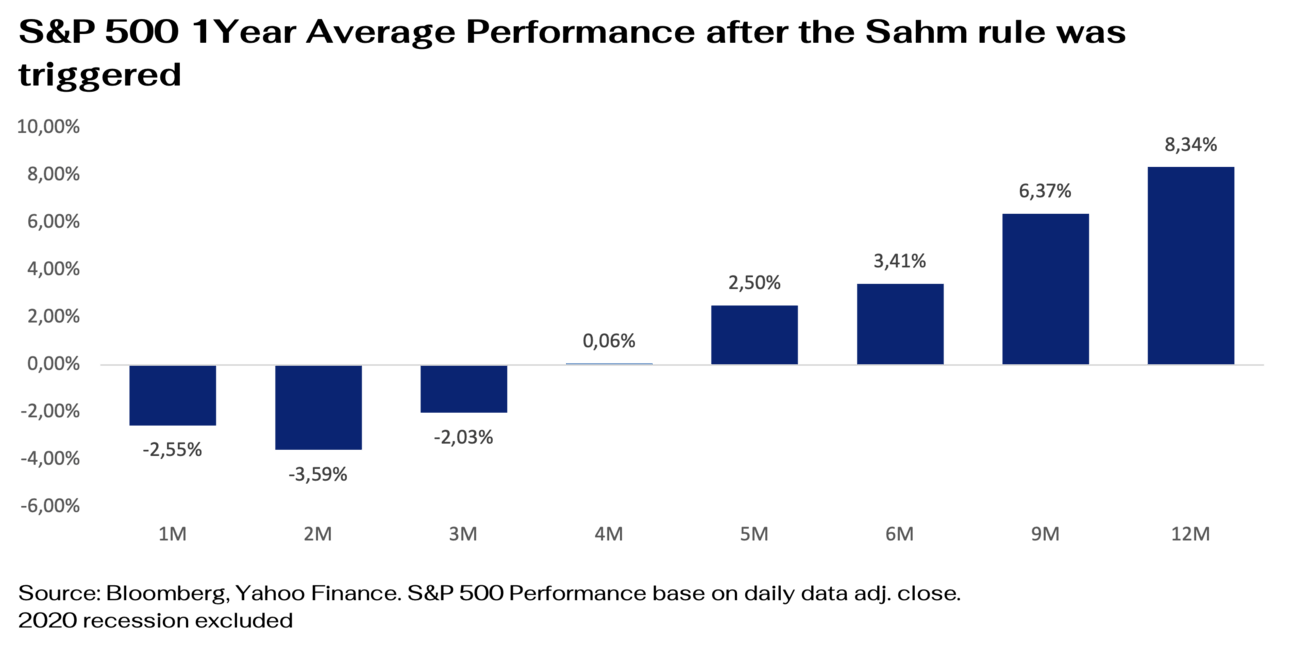

For the data table, I excluded the 2020 recession since it was caused by an entirely external shock unrelated to economic dynamics (2020 being the best 1-year performance alongside 1960). Even without including 2020 in the average, the results are not bad, but it’s important to note that in the worst-case scenarios, 1-year returns dropped by -41.90% in 2008 and -24.74% in 2001. (To recover from a 42% loss, a return of nearly 70% is required.)

Within the sample, we can also observe that in the first six months, negative performance is more prevalent than positive performance.

In conclusion, as a lagging recession indicator, we can observe that the worst returns typically occur one year before the Sahm Rule is triggered, rather than one year after. However, in cases of severe recessions like those in 2001 and 2008, the one-year performance following the activation of the rule was notably poor. The Sahm Rule is a relatively new indicator, developed through backtesting. While it has accurately signaled past recessions, this does not guarantee the same outcomes in the future. Nonetheless, considering various scenarios, the one-year results are not alarming in most cases.

Let’s see what happens and if history repeats itself.